Kansas City Auto Insurance

Kansas City Auto insurance costs an average of $40 per month, but you could be paying less. Please read below to find out what determines your rates.

How much do I pay for auto insurance in Kansas City?

Average auto insurance in Kansas City, Missouri is $1,780 per year. It is a bit above the statewide average in Missouri which is currently at ($1,724). Continue reading to find out how much you can expect to be paying for auto insurance, of course this does determine based on your credit, marital status, gender, homeowners discounts and other factors.

How can I save on my car insurance?

One of the best ways to save on car insurance is to get different rates from as many providers as possible, then you select the insurance provider with the lowest most affordable quote. In Kansas City, there are various providers that give you the most affordable rates for various types of insurance. Us here at Matrix Insurance using our expertise and the latest comparable technology software, we are able to give you a quote from various different companies and provide you with the lowest rate in town. So you don’t have to do all the searching.

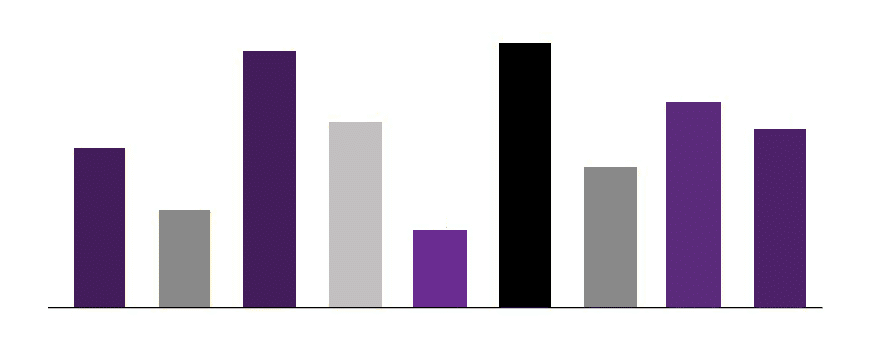

Is car insurance based on my age?

Kansas City auto owners in their 40s have pretty good affordable car insurance. Saving them hundreds a year on average. The rates for Kansas City drivers in their 50s also save about the same a year.

However its different for Teenage drivers in Kansas City they pay the most in auto insurance rates. The insurance cost seems to decrease in their 20s.

Kansas City Auto Insurance rates and marital status and gender

In different scenarios a driver’s gender and marital status can have an impact on the car insurance rates that they pay. In some areas, a single drivers pay a bit more than married drivers . This is due to the data collected, single drivers are most likely to file a claim. In some instances the same can apply to widow drivers. Widow drivers pay less on insurance than single drivers.

When it comes to gender however, female drivers pay about $11 dollars more per year than male drivers on car insurance in Kansas City.

Kansas City auto insurance rates on records accident and tickets MVR

If you have a clean driving record you can expect to save a whole lot on car insurance. Tickets like speeding, driving recklessly, DUIs or DWIs, accidents at-fault can cause your insurance rates to jump up.

Kansas City Auto Insurance using Credit rating

One of the most important tools in life is credit. Drivers with good credit usually save more money on car insurance as opposed to those with bad credit. Kansas City drivers who go from a poor credit rating of 302-580 to Good status 680-720 or higher can save as much as 65% on their auto insurance cost.

Are some areas more affordable car insurance in Kansas City?

Depending where in Kansas City you live can also affect your car insurance rates. This factor is one of the most important and biggest since it will depend on how much you will pay on car insurance. One of the most famous reasons for this, claims like theft and other crimes can vary by zip code. The rates could be higher or lower depending on the zip code where you live.

Below are just some zip code samples

Costly Kansas City: 64123, 64127, 64128, 64121

Cheaper insurance in Kansas City: 64052, 64054, 64055, 64012, 64079